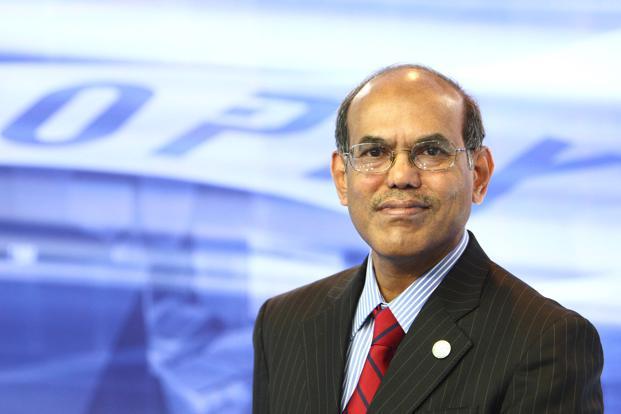

Dr Subbarao became Governor of the Reserve Bank of India (RBI) on 5 September, 2008. Less than two weeks later, Lehman Brothers collapsed, precipitating a global economic downturn not seen since the 1930s.

“The US was at the epicentre of this crisis. US financial markets were seized with fear and panic. Banks and insurers were collapsing or close to collapse. And the economy was plunged into recession. The dollar should have sunk to new lows. But the reverse happened. As the number one reserve currency, the dollar surged in value and exchange rates plummeted,” says Subbarao.

The dollar’s status had a particular impact on emerging markets, who were unable to secure swap lines with the US. The rupee alone depreciated by more than 10% in one month, for example, even though India was not directly involved in the Global Financial Crisis.

For Subbarao, this exposed an unsettling vulnerability: India, in common with scores of other nations, was heavily reliant on the US dollar, yet US policymakers were primarily focused on their domestic agenda. The Global Financial Crisis highlighted this paradox and it was reinforced several times in subsequent years.

“In the immediate aftermath of the crisis, we had to sell dollars to prevent our currency going into freefall. During Quantitative Easing, we had to buy dollars to protect our financial stability. And when the Federal Reserve began to taper QE, exchange rates slumped again and we had to defend ourselves with our reserves. All these events prompted one obvious question – is there an alternative to the dollar?” Subbarao explains.

When the euro was launched at the turn of the century, many European policymakers hoped that it would rival the dollar’s dominance. This has not happened and few observers expect it to.

If emerging markets cannot rely on the dollar as a guard against exchange rate instability, then we have to build our own defences. Holding gold within our reserves is an integral part of that self-defence

Over the past decade and more, however, the RMB have moved into the foreground, with central bankers wondering if it could become a leading reserve currency. Subbarao acknowledges that the RMB is on a path of internationalisation but he believes further developments are some way away.

“Several conditions need to be in place for the RMB to become a genuine reserve currency. Above all, China would need to run a current account deficit but it does not. It runs a surplus,” he says.

For Subbarao, the solution to this conundrum was clear.

“If emerging markets cannot rely on the dollar as a guard against exchange rate instability, then we have to build our own defences. Holding gold within our reserves is an integral part of that self-defence,” he says.

Some economists point to alternative solutions, such as capital controls. Subbarao is unconvinced.

“Experience has shown that capital controls are problematic. They are distortionary, ineffective and costly. And they raise more questions than they answer,” he says.

Emerging markets are also advised that they can use the IMF as a safety net, rather than building up costly foreign exchange reserves,. Again, Subbarao is unconvinced.

“There is still a real stigma attached to going to the IMF, particularly in Asia. By contrast, having a war chest of reserves inspires confidence among investors and thereby reduces funding costs” he explains.

And, as Subbarao points out, these reserves do not need exclusively to consist of foreign currency assets. They can include gold.

The key question is: how much? Central bank reserves are expected to fulfil three criteria: safety, liquidity and return. The proportion of gold held by individual institutions depends, says Subbarao, on the relative weight they place on these objectives.

“Whatever the answer to that question, it is clear that gold is a risk diversifier – a hedge against not just financial risk but also political risk. It is also a long-term store of wealth. As such central banks, especially those from emerging markets, can increasingly see the merits of adding gold to their reserves,” says Subbarao.

“Over time, therefore, I am confident that gold’s role will increase among central banks,” he adds.

Gold is a risk diversifier – a hedge against not just financial risk but also political risk. It is also a long-term store of wealth. As such central banks, especially those from emerging markets, can increasingly see the merits of adding gold to their reserves.

Behaving like a hedge fund

When Dr Subbarao became Governor of the Reserve Bank of India (RBI), the central bank held some 358 tonnes (t) of gold, equivalent to around 3.5% of its total reserves.

Subbarao felt that this was not enough. He and his colleagues debated the issue many times before he took office – but no conclusion was reached. The Global Financial Crisis changed the nature of the debate.

“The Crisis called into question the long-term health of the dollar as a safe asset. As a result, the appeal of gold increased,” he says.

This was 2009, when countries around the world had tipped into recession and the International Monetary Fund had announced the sale of 403t of gold to put its finances on a sound long-term footing. Central banks were offered first refusal.

“We were sorely tempted. This was an opportunity to buy from an international institution at a time when we wanted to increase our holdings. But we were also worried about the consequences if the price dropped,” Subbarao recalls.

The RBI decided to acquire 200t of gold, agreeing with the IMF that the price would be calculated as an average market price over the following ten working days.

In the event, the RBI decided to acquire 200t of gold, agreeing with the IMF that the price would be calculated as an average market price over the following ten working days. That was at the end of October.

“A small team of us worked in the utmost secrecy. We could not afford to let anyone know what we were doing, as this might have affected the price,” says Subbarao.

The ten-day period ended on Monday, 2nd November. At 6pm on 3rd, the RBI paid for the gold and by 9pm, it had been transferred to their account. The following morning, a joint press release was published.

“There was surprise, appreciation, even envy in the bullion and currency markets – and widespread speculation as to why we had done it,” says Subbarao.

Some people thought the purchase had been made to redeem India’s honour, after having pledged its gold during the country’s 1991 balance of payment crisis. Some thought it was a personal redemption for Subbarao, who had signed the pledge 18 years previously.

“The truth was far simpler,” says Subbarao. “Gold is a good long-term investment and a reliable reserve asset.”

Courtesy: Gold.org

You must be logged in to post a comment Login