RJ Market Watch

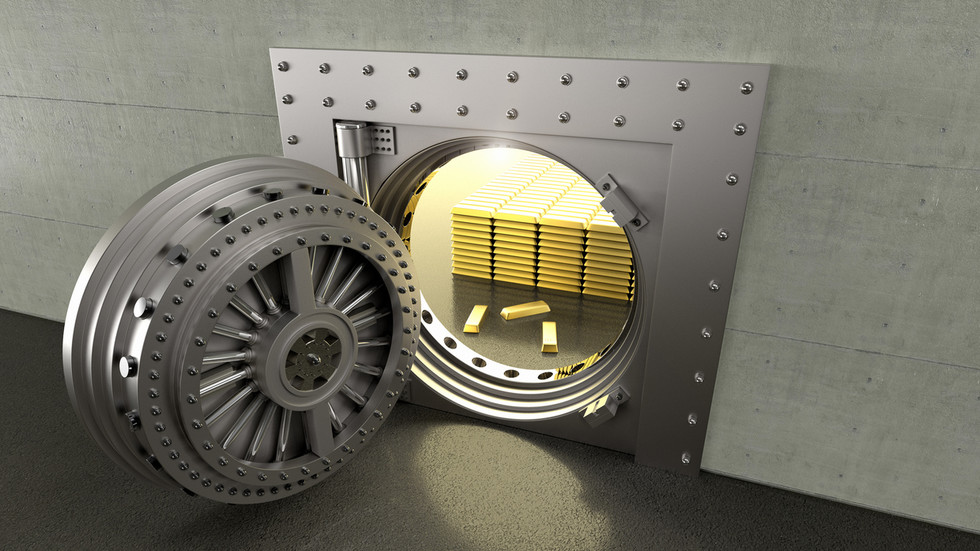

This could be a game changer for gold investors; Tradewind Markets to digitize gold

As the rise of digital assets allows swifter movement of capital, investors now have an alternative asset to buying physical gold: digital gold.

Using Vaultchain technology, which is a ledger platform based on blockchain, Tradewind Markets is connecting investors with physical gold bullion through electronic records.

Unlike with and ETF, Tradewind allows investors to take possession of the gold, said CEO Michael Albanese.

“With our platform, the ownership records are transparent, the Canadian mint will recognize our records as title, and you’ll be able to seamlessly take possession,” Albanese told Kitco News.

Albanese noted that a ledge system of trading gold opens up many more possibilities for both retail and institutional investors.

“The other big appeal to physical gold represented on a ledger like ours is that there’s a lot you can do with that gold once it is represented on a ledger. You can lend it for return and start to create some income stream on the gold, so the second segment is institutions, and I think it’s quite exciting we’re trying to help institutions create a bit of a return on an asset that doesn’t traditionally have one,” he said.

On the outlook for gold, Albanese said that it all comes down to the dollar.

“A lot will depend on what goes on with the dollar, and I think a lot will depend, and this relates to our product a bit…on sovereign institutions. You do see, over the last six months or so, sovereign institutions accumulating large amounts of gold, and I do in the back of my mind wonder what that means to prices twelve months from now,” he said.

Courtesy: KITCO

Wide Angle8 months ago

Wide Angle8 months agoAmerican Gem Trade Association bans exhibition of lab-grown gemstones at its shows

RJ Market Watch9 months ago

RJ Market Watch9 months ago5th Retail Jeweller Dubai Forum 2024 set to decode Next-Gen retail and ways to drive its success

RJ Market Watch7 months ago

RJ Market Watch7 months agoKanz Jewels wins over customers’ hearts with electrifying event featuring Indian singer Kailash Kher

Daily News11 months ago

Daily News11 months agoJoyalukkas launches second showroom in the United Kingdom in London

You must be logged in to post a comment Login